The choice of battery cell technology can dramatically impact price and availability

- Insights

- 30 June 2022

The choice of battery system for a maritime application is primarily based on what operational profile it will serve. However, as a consequence of events like the pandemic, supply chain and logistics problems and the war in Ukraine, other aspects are becoming critical to consider: Like how the global raw materials situation will impact pricing and availability of different systems in the coming years. A new report shares some interesting points around this. This post aims to add some insights that applies to the ongoing electrification of the maritime industry.

Maritime electrification is entering implementation mode. More and more projects are being realized, and the scope of the projects are increasing from kilowatts (kWh) to megawatts (MWh).

While these changes are progressing rapidly there are a number of developments on a macro level that will have a tremendous impact on which battery technology shipping companies should opt for. The impact will be on both the price for a particular technology as well as the availability of that type of battery in itself. Put another way, ship owners and operators may be paying a lot of money for a battery technology now, only to find in a few years from now that they can’t expand on or replenish that system.

Threats to raw materials

Some key factors to be aware of are that not all battery technologies will be impacted to the same extent. Not just their composition but also how efficient they are will affect both how much you have to pay upfront and your operational costs.

In addition to this, the on-going electrification of the automotive industry will have a great impact on the maritime industry with stockpiling of raw materials and demand that putting pressure on supply chains.

A new report from Fastmarkets outlines a ten-point risk matrix for battery raw materials. Some of these points will impact the use of battery systems in the maritime industry immensely. Understanding and awareness of what drives supply chain problems and prices will help you deciding what battery solution to go for.

In this article we are going to highlight three of the points raised in the report:

- Price volatility

- Supply scarcity

- Production and logistics disruptions

Price volatility

The battery type best suited for the demands of the shipping industry are Lithium-ion batteries.

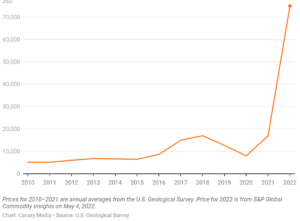

Image: Lithium prices have spiked sky-high. The chart shows battery-grade lithium carbonate per metric ton (U.S. dollars)

There are different types of Lithium-ion batteries, however, and it’s the composition of them that is of interest in this context. The three types commonly used are NMC, LFP and LTO batteries.

NMC combines Lithium with nickel, manganese and cobalt, while LFP batteries use iron and phosphate. LTO batteries, finally, rely on a lithium titanate anode. The differences in components will impact pricing both directly and indirectly.

The direct impact is caused by the price of lithium, cobalt and other raw materials have surged in the last 12 months as battery makers and automakers have ramped up production and competed for supply. The report from Fastmarkets points to NMC batteries as an example here:

Because of the combination of lithium, cobalt etc., one of the most popular compositions, NMC 622, is theoretically 150% more expensive than at the start of 2020.

But the indirect, and most dramatic impact hinges on battery efficiency. While the demand for lithium in itself is the biggest driver of increasing prices, what the cost will be ultimately depends on how many batteries each ship needs.

In a maritime setting, LTO batteries are more efficient than both NMC and LFP batteries. If you decide on a LTO battery systems you will be impacted by the increased price of Lithium, but they require a lot less battery modules to deliver the required energy over the design lifetime. In some cases, up to 50 percent less than what is needed for NMC batteries. This means that you in the end will pay more if you go for a LFP or NMC solution.

The higher efficiency is a major benefit, not the least because of the fact that well-to-wake energy efficiency will be subject to taxation in the near future. IMO’s regulatory frameworks EEXI, CII and SEEMP all target energy efficiency, carbon intensity and overall ship efficiency and will enter into force in January 2023. The EU also addresses energy efficiency with its FuelEU regulation (a part of the Fit For 55-package), imposing life cycle GHG footprint requirements on the energy consumption on board ships and will enter into force in 2025 – which make batteries in general compliance and cost saving measure.

Supply scarcity

While the maritime industry is making batteries part of its energy mix, another and much bigger industry is going through a revolution that is putting batteries front and center of what it does. To automakers the electrical vehicle is the future. To most manufacturers this is where their innovation and development budgets are spent, and electric vehicles represents a critical future revenue stream.

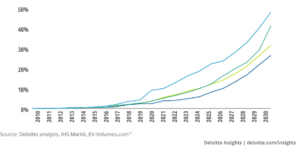

Image: Outlook for EV market share by major region

There is one critical challenge for automakers: how to produce enough batteries. And this risk trickles down to the maritime industry – that will increasingly find itself behind bigger and smaller car brands in the queue for raw materials and battery cells.

According to Fastmarkets, from now and during the next couple of years, automakers are likely to tum to futures contracts to hedge price risk and smooth out financial results. And it’s unlikely that economies of scale will be in place before the end of the decade, countering high prices. This means that high costs will continue to eat into margins and impact decision on what type of battery composition to select. All of this will have an impact on the maritime industry as well.

However, there is one key factor to keep in mind here. There are different requirements for batteries that provide the most efficiency in a car, and those that work best in ships. Most maritime vessels require battery systems that are durable, compact and can withstand tough cycling conditions over longer durations. For many operational profiles in the maritime industry, maximum efficiency is a combination of output, size and safety. In all three criteria, LTO batteries excel over for example NMC batteries.

“Most maritime vessels require battery systems that are durable, compact and can withstand tough cycling conditions over longer durations.”

Production and logistics disruptions

The third point to highlight from Fastmarkets reports relates to two important aspects of raw materials: Where they are found and how they are transported.

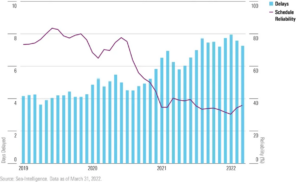

Image: Average delays and schedule reliability in global shipping

Lithium is produced in several countries, first and foremost Chile, Australia, Argentina and China, but also countries like Canada and Portugal. Cobalt, however, is mainly found in some parts of Africa and in China. This makes it vulnerable to both stockpiling and transportation difficulties.

In addition, the Covid-19 epidemic put a lot of pressure on supply chains across the globe. Raw material for battery production was certainly impacted by this. One example was the bottlenecks caused by nationwide lockdowns in South Africa as well as Australia. Sadly, we are unlikely to have seen the last of these disturbances, as Covid continues to threaten us – albeit to a lesser degree than previously.

Conclusions

From a maritime industry perspective, the key take-aways from Fastmarkets is that buyers need a deeper understanding how the current macro environment is affecting their cost basis and delivery times for maritime battery systems. There are differences between battery compositions and chemistries that ultimately have effect not only on performance, but also on price and availability. Look out for the following aspects as drivers for change and new evaluation criteria;

- With stockpiling and supply chain problems impacting price and availability of raw materials for a long time, investing in the right battery systems will have important ramifications for a long time.

- Maritime battery technologies are impacted by the price increases and other consequences. However, there are substantial differences between different battery types. LTO batteries is a high-power solution and therefore a lot less impacted than NMC batteries, since they rely on the same solution as most EV’s.

- The massive shift to EV’s will make the auto industry the number one buyer of raw materials, effectively crowding out other industries. But since the optimal battery technology for car batteries is different from what is required in the maritime industry, not all battery solutions and systems are threatened by this.